Featured News

Thimphu’s YDF hall buzzes with Deaf Week celebration

The YDF Hall in Thimphu came alive today with laughter, music, and the vibrant spirit of inclusion as the Disabled...

Journey of Karma Raygel, rescued elephant calf thrives under care in Jomotshangkha

Seven months ago, the officials of Jomotshangkha Wildlife Sanctuary in Samdrup Jongkhar rescued a young elephant calf from the wild....

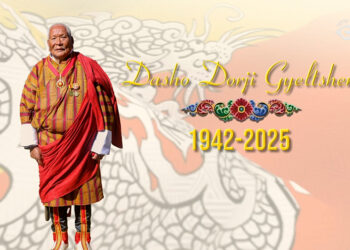

State funeral held for late Dasho Zimpon Dorji Gyeltshen, late Dasho chooses incineration over open-air cremation

The state funeral for late Dasho Zimpon Dorji Gyeltshen was held today. His Holiness the Je Khenpo presided over the...

Veteran archers compete one last time in spirit of tradition and tribute

As a heartfelt farewell to the sport they once dominated, some of Bhutan’s finest former archers returned to the archery...

Gyalsup homecomings spark joy and unity across Bhutan, with heartfelt reunions going viral on social media

In a wave of emotion sweeping across Bhutan, thousands of families are experiencing a homecoming unlike any other. Their sons...

From the King’s hand to the family’s altar

As the Gelephu Mindfulness City rises from vision to reality, it is not only bulldozers and blueprints that are shaping...

Thousands gathered at Kuenselphodrang to receive blessings from His Holiness the Je Khenpo and sacred relics from Thailand

Thousands of devotees flocked to Kuenselphodrang from as early as 3 AM today, eager to catch a glimpse of Their...

One rocket, thousand dreams; Pema Tsho Sakhu rewrites future for young Bhutanese innovators

At just 13 years old, Pema Tsho Sakhu, a Bhutanese student living in Australia, is already breaking barriers in space...

Bhutan prepares to welcome King and Queen of Thailand on state visit

Preparations to welcome Their Majesties King Maha Vajiralongkorn and Queen Suthida of Thailand are in full swing. Their Majesties will...

Centuries-old Londha festival in Dagana celebrates life, tradition and community

Bhutan's deep-rooted traditions and cultural heritage continue to thrive through vibrant local festivals, preserving the nation’s unique identity. Among them,...

Politics

PDP adds one more seat in Parliament with Trongsa by-election victory

The People’s Democratic Party increased its majority in the National Assembly after winning the by-election in Trongsa recently. The ruling...

Popular

-

Hydropower sector shows signs of recovery following last week’s floods

-

Tsirang’s Mahalal Rai wins Mr Bhutan Title at 14th National Bodybuilding Championship

-

Private companies along Amochhu seek flood protection measures

-

Martshala Middle Secondary School students make herbal soap to prevent skin diseases

-

MoIT assures immediate reconstruction efforts for flood-hit gewogs in Chhukha

Casino en ligne avec mise en argent réel

Choisissez un casino en ligne avec argent réel pour jouer à vos jeux préférés et retirer vos gains en toute simplicité. Avec des options de paiement rapide et un environnement réglementé, vous bénéficiez d’un divertissement sûr et fiable.

Master programme in Acupuncture and Moxibustion in Bhutan reduces need for overseas studies

With the introduction of the Master Programme in Acupuncture and Moxibustion at the Faculty of Traditional Medicine, the government is...

British nun Ani Pema Deki starts 400km fundraising trek to raise funds for children with disabilities

Emma Slade, a British-born Buddhist nun also known as Ani Pema Deki, started her “A Woman with Altitude" walk across...

Druk Sokchop programme brings life-saving skills home, trains over 1,000 healthcare providers

From neonatal to advanced cardiac life support, the Druk Sokchop or Bhutan Lifesavers programme has trained over 1,000 healthcare providers...

His Majesty The King grants Royal Kashos for three new spiritual landmarks in Gelephu Mindfulness City

Three new spiritual projects have been officially approved by His Majesty The King, Chairman of the Board of Directors of...

Zakar

Recent News

- Master programme in Acupuncture and Moxibustion in Bhutan reduces need for overseas studies

- British nun Ani Pema Deki starts 400km fundraising trek to raise funds for children with disabilities

- Druk Sokchop programme brings life-saving skills home, trains over 1,000 healthcare providers

- His Majesty The King grants Royal Kashos for three new spiritual landmarks in Gelephu Mindfulness City

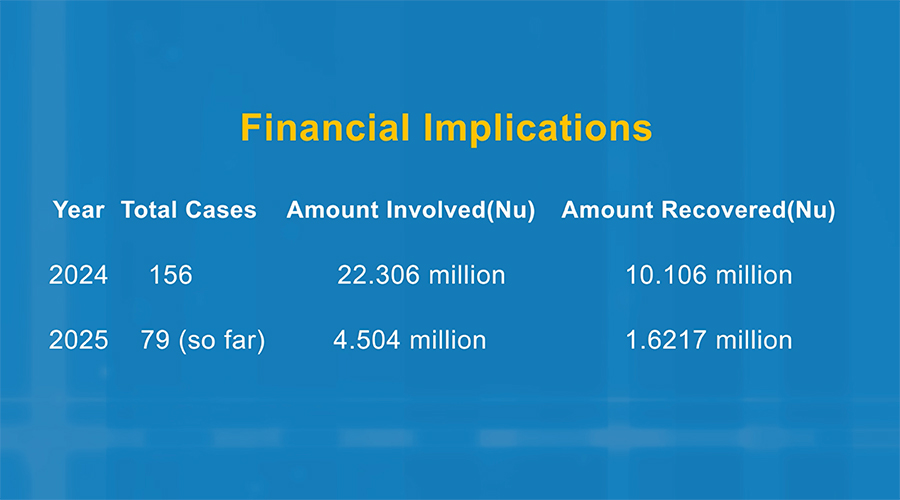

- Over 230 scam cases reported in two years

News Category

- Accidents

- Agriculture

- Announcement

- Audience Survey Report

- Business

- Crime/Legal

- Culture

- Development

- Disaster

- Economy

- Education

- Entertainment

- Environment

- Feature

- Featured

- Festival

- GMC

- Headlines

- Health

- HYDROPOWER

- Legal

- Literature

- Livestock

- Media

- Other Stories

- Politics

- RCSC

- Recent stories

- Religion

- Sci/Tech

- Social

- Sports

- Technology

- Tourism

- Uncategorized

- Video

- Video Story

- Wildlife

© 2024 BBSCL. All rights reserved.