Recent Stories

Samdrup Jongkhar town to have clean and reliable drinking water

The long-standing water shortage in Samdrup Jongkhar town is finally expected to be solved. Residents can now look forward to...

Bhutanese karatekas gear up for 1st edition of Sikkim International Karate Championship

Thirteen Bhutanese karatekas will represent Bhutan at the first edition of the Sikkim Open International Karate Championship in Gangtok. The...

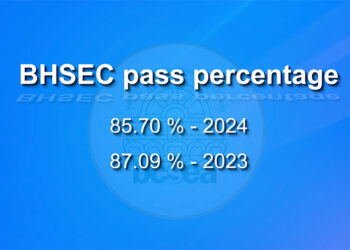

Classes XII and VIII pass percentage drops in 2024

The pass percentage for classes XII and VIII students dropped last year. The class XII pass rate has decreased by...

Moon gazing to raise funds for kidney patients

Under the glow of the year’s first full moon, also known as the Wolf Moon, a group of youths came...

Prime minister instructs vehicle dealers to refund customers for overcharged Green Tax

The prime minister has instructed vehicle dealers in Thimphu and Phuentsholing to refund customers for overcharged Green Tax within a...

Opposition Party calls Economic Stimulus Programme irrelevant or unnecessary

The Opposition Party do not find the Economic Stimulus Programme or ESP relevant or necessary. During a press conference today,...

Politics

RCSC defends PME category, proposes targeted support for civil servants

The Royal Civil Service Commission (RCSC) indicated that it is exploring alternative support measures for civil servants classified under the...

Popular

Recent News

New irrigation scheme promises better yields and livelihoods in Dagana

Farmers of Thasa and Kompa chiwogs of Dagana’s Laja Gewog will finally have access to reliable irrigation water starting this year. The irrigation water scheme for the two chiwogs is nearing completion. This is expected to boost agricultural production, especially rice yield and improve farmers’ livelihoods. Farmers in Thasa Chiwog are currently busy threshing paddy grown mostly using rainwater and...

Commuters demand road safety measures on foggy Samtse-Phuentsholing highway

Commuters travelling along the Samtse-Phuentsholing highway are calling on authorities to address pressing safety concerns. Poor visibility caused by fog is frequent, especially during the monsoon season and has made travelling along the newly blacktopped road increasingly dangerous. People say there is a need to install road markings, crash barriers, and traffic signs along the highway. Located at an altitude...

Monggar’s Gyaltsuen Jetsun Pema Mother and Child Hospital 80% complete, to be ready by July

The 65-bed Gyaltsuen Jetsun Pema Mother and Child Hospital in Monggar is 80 percent complete. It is on track for completion by July this year. The construction began in July 2022 and is set to be completed within the planned 36-month duration. India is funding the project worth about Nu 935 M. The 65-bed Gyaltsuen Jetsun Pema Mother and Child...

Lack of oil extraction machine hampers Dagana’s mustard growers

Many farmers in the country have stopped cultivating mustard due to the availability of imported oil and the labour-intensive extraction process. However, in Dagana's Maenchhuna village, about 30 households still cultivate mustard as a source of income. The lack of an oil extraction machine has made processing mustard into oil challenging. Most farmers in Maenchhuna village grow mustard, with plots...

Recent News

- Stock market participation soars: transactions increase tenfold since 2018

- Sonam Norbu appeals 15-year manslaughter sentence to High Court

- Patients at JDWNRH welcome additional token counters, call for more doctors

- Innovate Bhutan Centre introduces KidsMBA for future entrepreneurs

- Turning plastic waste into opportunities

News Category

- Accidents

- Agriculture

- Announcement

- Business

- Crime/Legal

- Culture

- Development

- Disaster

- Economy

- Education

- Entertainment

- Environment

- Featured

- Festival

- GMC

- Headlines

- Health

- Legal

- Literature

- Livestock

- Media

- Other Stories

- Politics

- RCSC

- Recent stories

- Religion

- Sci/Tech

- Social

- Sports

- Technology

- Tourism

- Uncategorized

- Video

- Video Story

- Wildlife

© 2024 BBSCL. All rights reserved.