Featured News

Paro turns up the volume with Bhutan’s first Asia Rock Festival

As prayer flags fluttered in the evening breeze and the sun set behind Paro’s dzong, monasteries and temples, a new...

His Holiness the Je Khenpo concludes spiritual tour

His Holiness the Je Khenpo concluded the almost month-long spiritual tour across the country. Today, His Holiness visited Pedkar Choeling...

Asia Rock Fest–Bhutan marks new era for local rock scene

Bhutan is about to experience something completely new, its first full-scale rock music festival. But this moment did not happen...

British nun Ani Pema Deki completes 400km trek from Haa to Trashigang, raising over Nu 9 M for children with disabilities

Ani Pema Deki, also known as Emma Slade, has completed her 400-kilometre walk across the Trans-Bhutan Trail to raise funds...

Moments with the Great Fourth: memories that still touch Bhutanese hearts

For many Bhutanese, a moment shared with His Majesty the Fourth Druk Gyalpo remains one of the most treasured moments...

His Majesty the Fourth Druk Gyalpo’s timeless vision of happiness still shapes Bhutan’s future

In a world chasing growth through numbers, Bhutan chose to measure something far deeper: happiness. As the nation celebrates the...

JSW Law Graduate makes mark in the U.S., clears New York Bar Examination

A young Bhutanese woman lawyer has made a mark in the international legal arena by passing the prestigious New York...

Thimphu’s YDF hall buzzes with Deaf Week celebration

The YDF Hall in Thimphu came alive today with laughter, music, and the vibrant spirit of inclusion as the Disabled...

Journey of Karma Raygel, rescued elephant calf thrives under care in Jomotshangkha

Seven months ago, the officials of Jomotshangkha Wildlife Sanctuary in Samdrup Jongkhar rescued a young elephant calf from the wild....

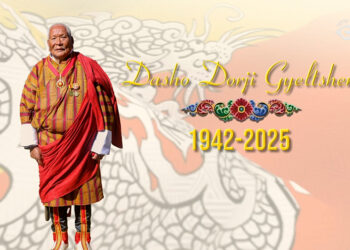

State funeral held for late Dasho Zimpon Dorji Gyeltshen, late Dasho chooses incineration over open-air cremation

The state funeral for late Dasho Zimpon Dorji Gyeltshen was held today. His Holiness the Je Khenpo presided over the...

Politics

FASTag access for Bhutanese vehicles nears resolution as India submits SOP draft

The foreign affairs and external trade ministry has received a draft Standard Operating Procedure from the Indian government concerning the...

Popular

-

Businesses in Haa struggle as population continues to shrink

-

New girls’ hostel to ease accommodation challenges at Faculty of Traditional Medicine

-

Paro installs reverse vending machine to tackle growing waste

-

National Veterinary Hospital makes life-saving vet services available, many pet owners still unaware

-

‘News in Tales’ workshop equips Bhutanese journalists with narrative storytelling skills

Casino en ligne avec mise en argent réel

Choisissez un casino en ligne avec argent réel pour jouer à vos jeux préférés et retirer vos gains en toute simplicité. Avec des options de paiement rapide et un environnement réglementé, vous bénéficiez d’un divertissement sûr et fiable.

Over 8,000 volunteers to take part in Fourth Phase of GMC works

More than 8,000 registered volunteers will take part in large-scale environmental and infrastructure works across Gelephu, as the fourth phase...

NC debates Bhutan-Thailand FTA amid job and reserve concerns

During today’s National Council deliberation on the Free Trade Agreement between Bhutan and Thailand, MPs raised concerns over potential job...

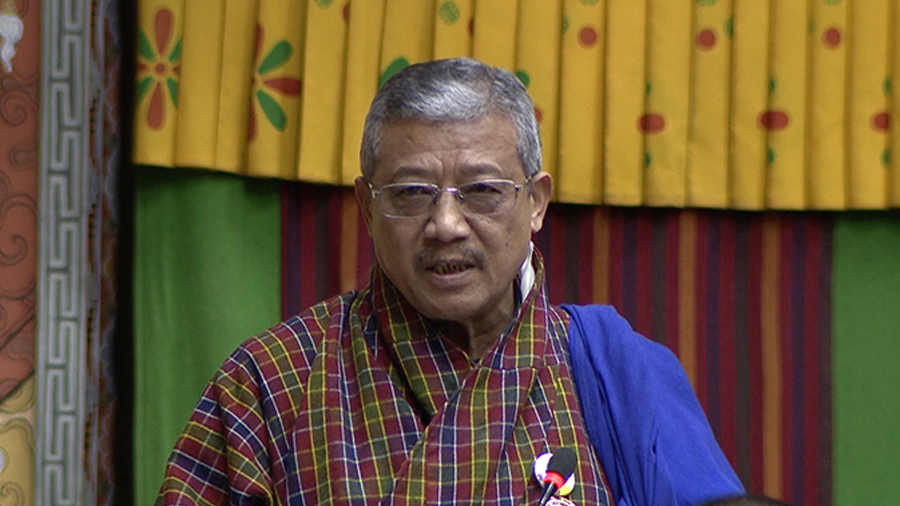

Mismatch between PAVA and bank valuations limits rural credit access, parliamentarians urge consistent land valuation

Harka Singh Tamang, Member, Economic and Finance Committee Differences between bank and government land valuations mean rural landowners often get...

Temporary alternate road restores access to Deling-Marpji after month-long landslide, Chhukha

Residents of Phuentshogling Gewog's Deling-Marpji Chiwog in Chhukha can finally breathe a sigh of relief after authorities completed a temporary...

Zakar

Recent News

- Over 8,000 volunteers to take part in Fourth Phase of GMC works

- NC debates Bhutan-Thailand FTA amid job and reserve concerns

- Mismatch between PAVA and bank valuations limits rural credit access, parliamentarians urge consistent land valuation

- Temporary alternate road restores access to Deling-Marpji after month-long landslide, Chhukha

- Paro installs reverse vending machine to tackle growing waste

News Category

- Accidents

- Agriculture

- Announcement

- Audience Survey Report

- Business

- Crime/Legal

- Culture

- Development

- Disaster

- Economy

- Education

- Entertainment

- Environment

- Feature

- Featured

- Festival

- Global Peace Prayer Festival

- GMC

- Gyalsung

- Headlines

- Health

- HYDROPOWER

- K4 70th Birthday special feature

- Legal

- Literature

- Livestock

- Media

- Other Stories

- Politics

- RCSC

- Recent stories

- Religion

- Sci/Tech

- Social

- Sports

- Technology

- Textile

- Tourism

- Uncategorized

- Video

- Video Story

- Wildlife

© 2024 BBSCL. All rights reserved.